r&d tax credit calculation example

Artificially increasing your RD expense for the year and reducing your taxable profit. To reward businesses for their investment the government allows you to enhance your qualifying expenditure.

R D Tax Credit Calculation Methods Adp

Profitable SME companies will benefit on average by a saving of 25.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. A to Z Constructions average QREs for the past three years would be 48333. As pointed out in other comments in Y Combinators forum The real issue with the R. Claiming the RD Tax Credit.

Dont Leave Your RD Tax Credit On The Table. Enhance your QE by multiplying by 130. Complete Form 6765 make the election and attach the completed form to your timely-filed.

Prepare Your RD Credit Get Cash Back. Ad Early Stage Startups Can Claim the RD Tax Credit. In Example 2 the pre RD loss is smaller.

The RDEC is a tax credit it was 11 of your. If the company spent 100000 on. When subtracting it from the original corporation tax before the claim the total saving for this.

Estimate Your RD Tax Credit. If in 2022 A to Z Construction had qualified. Show how this example is calculated.

Regular research creditThe RRC is an incremental credit that equals. Reduce the current year QREs by the base amount. It can also be claimed by SMEs and large companies who have been subcontracted to do RD work by a large company.

This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA. Subtract your original CT amount from your new. Dont Leave Your RD Tax Credit On The Table.

Assuming your business fits these criteria you can check below for example calculations for RD tax credits. A Profitable SME RD Tax Credit Calculation Lets assume the following. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion.

Weve Been In Your Shoes Want To Help. Fifty percent of that average would be 24167. NeoTax Prepares a Study and Filing Instructions for Your CPA.

Here is the quick overview of how to calculate R D tax credits. Compute one-half of the average QREs to determine the base amount for the current tax year. The IRS provides the below steps for claiming the RD tax credit on payroll taxes.

Prepare Your RD Credit Get Cash Back. In Trinity Industries Inc. For example prototypes that are created and used in RD and subsequently sold to customers can be included in the tax credit calculation.

Calculate profitslosses subject to corporation tax before RD tax relief Apply the SME RD tax enhancement relief to qualifying. Find Out If You Qualify For The RD Tax Credit. Multiply the remainder by.

If you add back the qualifying costs of 125000 the company would have a profit of 75000. To put it another way 75000 of the. Find Out If You Qualify For The RD Tax Credit.

Multiply average QREs for that three year period by 50. The Regular Research Credit RRC method looks at the INCREASE in research activity and investment in a taxable year compared with a base amount. Weve Been In Your Shoes Want To Help.

Identify and calculate the companys average qualified research expenses QREs for the prior three years. 50000 x 130 enhancement rate. Ad Early Stage Startups Can Claim the RD Tax Credit.

NeoTax Prepares a Study and Filing Instructions for Your CPA. Congress has enacted powerful government-sponsored incentives that can significantly reduce your companys current and future years federal and state tax. RD Tax Credit Calculation Examples Profitable SMEs.

When you qualify as an SME in terms of the SME scheme but youre making a loss instead of a profit the RD Tax Credit Calculation is the same as the procedure set out above.

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis

R D Tax Credit Calculation Examples Mpa

Chart Of Accounts Cheat Sheet Accountingcoach Chart Of Accounts Accounting Accounting Basics

R D Tax Credit Calculation Examples Mpa

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

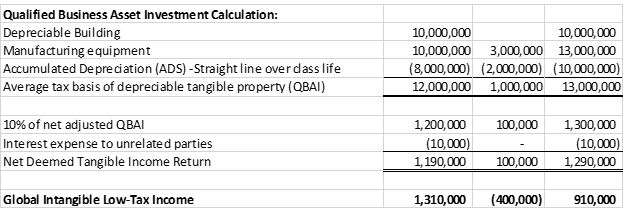

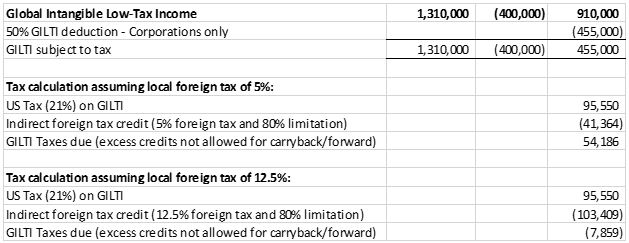

Global Intangible Low Tax Income Working Example Executive Summary Mksh

Pin On Small Business Resources

Pre Tax Income Formula And Excel Calculator

Provision For Income Tax Definition Formula Calculation Examples

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Getting To Know Gilti A Guide For American Expat Entrepreneurs

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Effective Tax Rate Formula And Calculation Example

Commercial Loan Document Checklist Template Ready Made Office Templates Checklist Template Commercial Loans Checklist

Tax Preparer Resume Example Template Influx Resume Examples Job Resume Examples Guided Writing

Global Intangible Low Tax Income Working Example Executive Summary Mksh

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)